Recession Looming? Signs and Strategies

Emily Willis

Photo: Recession Looming? Signs and Strategies

The global economy operates in cycles, with periods of growth often followed by contractions. Understanding these economic shifts, particularly the possibility of a recession, is crucial for individuals and businesses alike. While the term "recession" can evoke anxiety, being informed about its signs and preparing proactively can significantly mitigate its impact. This article will delve into what a recession entails, the key indicators to watch for, and actionable strategies for both personal finance and business resilience.

What is a Recession?

At its core, a recession is a significant, widespread, and prolonged downturn in economic activity. While there's no single, universally agreed-upon definition, a common rule of thumb is two consecutive quarters of negative Gross Domestic Product (GDP) growth. However, economists at the National Bureau of Economic Research (NBER), the official arbiter of U.S. recession dates, use a broader definition. They consider a range of factors, including real GDP, real income, employment, industrial production, and wholesale-retail sales, to determine if there's a "significant decline in economic activity spread across the economy, lasting more than a few months."

Recessions are a normal, albeit challenging, part of the business cycle. They can be triggered by various events, such as financial crises, external trade shocks, adverse supply shocks, or even large-scale natural disasters. During a recession, economic output, employment, and consumer spending typically drop. Central banks often respond by cutting interest rates to stimulate investment and support the economy.

It's important to distinguish a recession from a depression. While both are periods of economic contraction, a depression is far more severe and prolonged, characterized by widespread unemployment and major pauses in economic activity. Historically, depressions are rare, with the Great Depression of the 1930s being the most prominent example.

Key Economic Indicators: Are We Headed for a Downturn?

Spotting a looming recession involves monitoring several key economic indicators that act as the economy's vital signs. Some are "leading" indicators, changing before the broader economy, while others are "coincident" or "lagging," moving in tandem with or after the economic cycle.

Gross Domestic Product (GDP)

GDP measures the total market value of all final goods and services produced within a country. A contraction in GDP for two consecutive quarters is a widely used, though simplified, indicator of a recession. A sustained decline in GDP signifies that the overall economic output is shrinking, which has ripple effects across employment and consumer demand.

Employment and Unemployment Rates

The labor market is a cornerstone of economic health. A sustained increase in unemployment rates is a classic indicator of a recession. As demand for goods and services falls, companies may implement hiring freezes or layoffs to cut costs. Key metrics to watch include monthly non-farm payrolls and weekly initial jobless claims. A significant rise in initial jobless claims, perhaps 20-25% from their low, can be an early warning.

Economist Claudia Sahm developed the "Sahm Rule," which suggests a recession is likely underway or imminent when the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more relative to its low during the previous 12 months. This rule has historically identified recessions with remarkable accuracy.

Consumer Spending and Confidence

Consumer spending forms a significant portion of economic activity. If consumers feel anxious about job security, inflation, or the economic outlook, they tend to tighten their purse strings, postponing discretionary purchases. Surveys like the University of Michigan Consumer Sentiment Index and the Conference Board Consumer Confidence Index measure how optimistic households are about their financial situation and the broader economy. A sharp, sustained decline in these indices often precedes a drop in actual spending and can signal a potential recession. An "expectations index" falling below 80 has historically signaled a recession within the next year.

Manufacturing Output and Industrial Production

When companies cut down production and minimize risk exposure, it has a ripple effect. As fewer goods are produced, fewer resources like raw materials and labor are needed, leading to a drop in hiring and an increase in layoffs. Low industrial output and sales are therefore key indicators of an economic slump.

Interest Rates and Yield Curve Inversion

Central banks often raise interest rates to combat inflation. This increases the cost of borrowing, which can slow down the economy. One of the most closely watched and often uncannily accurate predictors of a recession is the inverted yield curve. Normally, investors expect higher returns (yields) for holding longer-term bonds compared to shorter-term ones. An inverted yield curve occurs when yields on longer-dated bonds drop below those on shorter-term bonds. This suggests that bond investors anticipate near-term economic weakness leading to eventual interest rate cuts by central banks, reflecting a pessimistic outlook for the near future. While not foolproof, this inversion has preceded most U.S. recessions since the 1960s. However, it's crucial to note that an inverted yield curve does not cause a recession; rather, it reflects market expectations.

Stock Market Performance

The stock market is often described as a forward-looking mechanism, taking into account future corporate earnings and economic growth. Sustained stock market losses, particularly a "bear market" (a drop of 20% or more in stock prices), can be a leading indicator of lower expected corporate profits and broader economic concerns. When stock prices decline significantly, it can also eat away at consumer wealth, potentially causing spending to drop.

Strategies to Navigate a Looming Recession: Personal Finance

Preparing for a recession involves taking proactive steps to strengthen your financial position. These strategies focus on building resilience and maintaining stability during uncertain times.

Build a Robust Emergency Fund

An emergency fund is your financial safety net. Aim to save at least three to six months' worth of essential household expenses in an easily accessible account, such as a high-yield savings or money market account. Some experts suggest even more, especially if you work in a high-turnover industry or are self-employed. This fund can provide crucial liquidity if your income is reduced or lost.

Reduce and Pay Down Debt

High-interest debt, such as credit card balances, can become a significant burden during an economic downturn. Prioritize paying down these debts. Less debt means lower monthly payments, freeing up more cash flow and reducing financial stress. Consider strategies like the "debt snowball" method to tackle smaller debts first for motivational wins.

Diversify Income Streams

Relying on a single source of income can be risky during a recession. Explore options for diversifying your income, such as:

- Side hustles: Freelancing, consulting, or part-time work can provide additional income and help build savings.

- Upskilling: Investing in new skills or certifications can make you more valuable in the job market and potentially open doors to new opportunities.

- Networking: Continuously building professional connections can be invaluable for finding new employment quickly if needed.

Review and Optimize Your Budget

A budget is a cornerstone of good financial health. Review your current spending habits and differentiate between essential expenses (housing, food, transportation) and discretionary spending (entertainment, dining out). Identify areas where you can cut back or delay non-essential purchases to free up more money for savings or debt repayment.

Invest Wisely and Diversify

While market volatility often accompanies recessions, it's generally advisable to stick with your long-term investment strategy. A diversified portfolio, spread across different asset classes like stocks, bonds, and real assets, is designed to weather market fluctuations. Avoid making impulsive decisions based on short-term market movements.

Strategies to Navigate a Looming Recession: Business Resilience

Businesses also need proactive strategies to not only survive but potentially thrive during an economic downturn. Recessions can present unique challenges but also opportunities for well-positioned companies.

Optimize Cash Flow and Liquidity

Cash is king during a downturn. Businesses should rigorously monitor and manage their cash flow, focusing on strengthening liquidity. This involves careful analysis of pricing strategies, cost structures, and ensuring steady and reliable cash flow. Negotiating favorable terms with vendors and managing accounts receivable proactively can also help.

Control Costs and Operational Efficiency

Reducing unnecessary costs is critical, but it's important to cut the right costs. Evaluate internal processes for inefficiencies and consider investing in new technology or digital transformation to improve productivity and save money in the long run. Identify and eliminate non-essential expenses while protecting core operations that generate revenue.

Retain and Upskill Your Workforce

While layoffs might seem like an immediate cost-saving measure, retaining and upskilling your existing talent can be a long-term advantage. Investing in employee development fosters a resilient company culture and positions the business for future growth when the economy recovers. It's often more cost-effective to retain skilled employees than to re-hire and train new ones

Latest ✨

View AllTransform your sales approach. Discover top modern sales techniques, including consultative selling, to connect, persuade, and build lasting customer relationsh...

Emily Willis

financial planning for the success of any business. It discusses key strategies such as creating a budget, managing cash flow, forecasting, managing debt, maximizing profitability, risk management, and utilizing technology.

Emily Willis

concept of minimalism as a way to declutter and simplify one's life. It highlights the benefits of minimalism, such as reduced stress, increased focus, and financial freedom.

Emily Willis

Transform buyers into brand advocates! Learn how email marketing leverages personalization & segmentation to cultivate unwavering customer loyalty.

Emily Willis

Business

View All

June 9, 2025

Influencer Marketing for Brand GrowthUnlock unstoppable brand growth! Discover how influencer marketing builds trust, amplifies reach, and boosts your bottom line in the digital age.

Emily Willis

August 5, 2024

Tips for Maintaining a Balance Between Work and Personal LifeAchieving a healthy work-life balance is essential for overall well-being, productivity, and happiness. Setting clear boundaries, prioritizing self-care, managing time effectively, nurturing relationships, and learning to unplug are key strategies to maintain this balance. It is important to communicate your needs effectively, seek support, and delegate tasks when necessary.

Emily Willis

June 18, 2025

Best Personal Loans: Your Guide to Smart BorrowingUnlock the secrets to finding the best personal loans. Our comprehensive guide helps you compare rates, understand terms, and secure the right financing for your needs.

Emily Willis

Economy

View AllThe digital economy has the potential to bring economic growth and innovation to developing countries, but there are several challenges that need to be addressed. These challenges include inadequate digital infrastructure, a digital divide that exacerbates inequalities, complex and outdated regulatory frameworks, cybersecurity risks, and limited access to financial services. However, there are opportunities for enhancing financial inclusion and economic growth. These opportunities include mobile and digital payments, implementing digital identification systems, e-commerce and market access, digital skills development, and public-private partnerships. By addressing these challenges and embracing the digital revolution, developing countries can unlock new opportunities for economic empowerment and inclusive growth.

Read MoreEconomic Stimulus: Do they work? Unpack government's toolkit, from fiscal to monetary policy, and understand their true impact on your economy.

Read MoreFintech innovation is reshaping finance. Unlock a new era of accessible, efficient, and personalized financial services with digital banking & AI.

Read MoreEntertainment

View All

August 5, 2024

Arts Education's Importance: Nurturing Creativity and Fostering ExpressionArts education is often overlooked in a world focused on standardized tests and STEM subjects, but it plays a vital role in nurturing creativity, self-expression, and essential skills in students. Arts education allows students to unleash creativity, build confidence, improve communication and collaboration skills, develop critical thinking and problem-solving abilities, increase cultural awareness and appreciation, and enhance emotional intelligence.

Emily Willis

August 4, 2024

Virtual Music Concerts: The Future of Live Performance?The music industry has seen significant changes in recent years, with virtual music concerts becoming a popular trend, especially due to the impact of the COVID-19 pandemic. Technological advancements have made virtual concerts more accessible and cost-effective, while also reducing the environmental impact of live events. However, challenges such as technical issues and the lack of physical presence remain. The future of virtual concerts may involve hybrid models that combine virtual and physical experiences, as well as continued technological innovation to enhance the quality of virtual performances. Building a sense of community and engagement will also be crucial for the success of virtual concerts moving forward.

Emily Willis

August 5, 2024

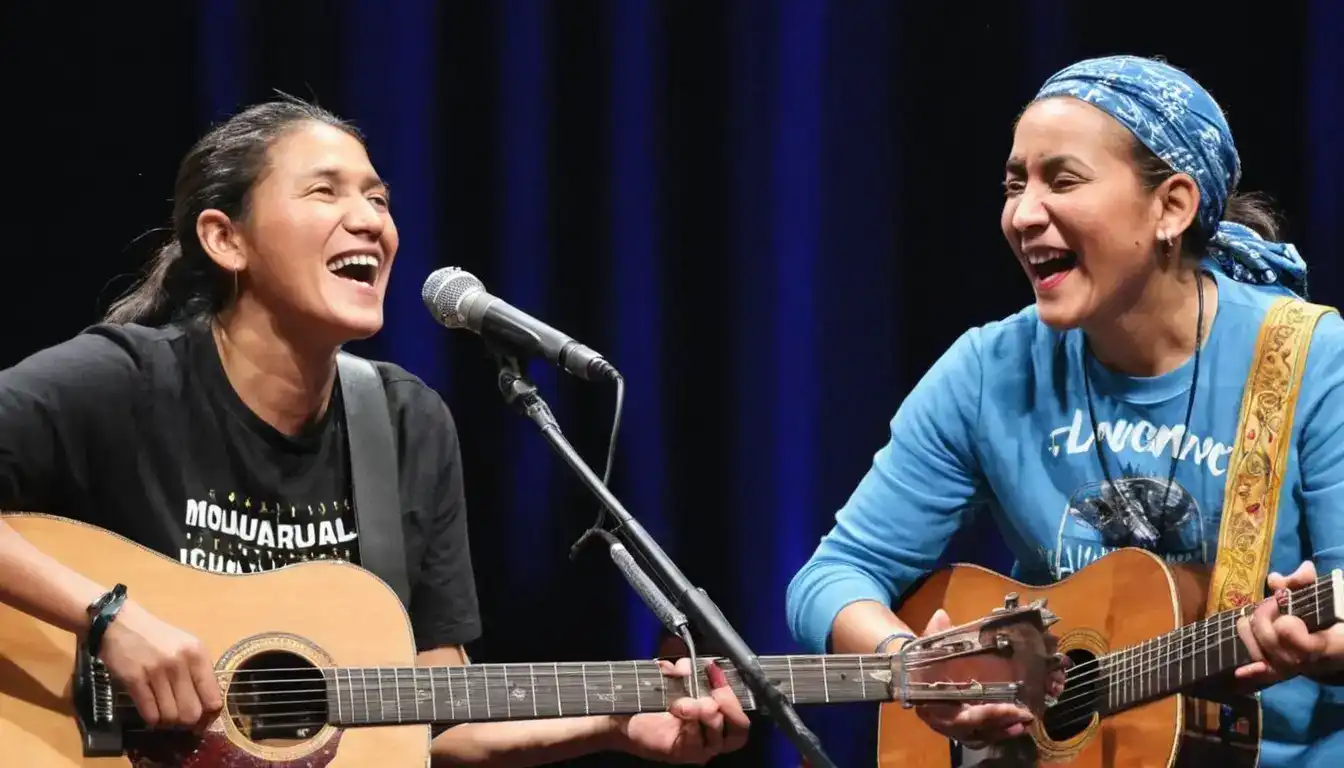

Music Universal Language: Connecting and Inspiring Across CulturesMusic has the power to transcend language barriers and connect people on a deep emotional level. It serves as a bridge between cultures, fostering understanding and appreciation for diversity. The universality of rhythm and melody creates a sense of unity, while the diversity of musical styles allows for exploration and creativity.

Emily Willis

Health

View AllHeart disease is a leading cause of death globally, but early detection and prevention strategies can reduce its impact. This article discusses the importance of early detection, common risk factors, preventive measures, and lifestyle changes for heart health. Understanding heart disease, recognizing symptoms, and undergoing regular screenings are crucial. Common risk factors include high blood pressure, high cholesterol, diabetes, smoking, obesity, physical inactivity, and family history. Symptoms of heart disease include chest pain, shortness of breath, fatigue, irregular heartbeat, and swelling. Diagnostic tests and screenings include blood pressure measurement, cholesterol screening, blood glucose test, ECG, stress test, and imaging tests. Preventive measures include adopting a heart-healthy diet, regular physical activity, quitting smoking, managing stress, maintaining a healthy weight, and limiting alcohol consumption. Medications and treatment options may be necessary for individuals at high risk or diagnosed with heart disease.

Emily Willis

Regular physical activity is crucial for maintaining long-term health and well-being. It has numerous benefits, including improving cardiovascular health, aiding in weight management, enhancing mental health, strengthening bones, boosting immune function, and promoting longevity.

Emily Willis

significance of mental health awareness in today's fast-paced world. It discusses the importance of understanding mental health, breaking down stigma, and promoting positive mental health practices.

Emily Willis

Trending 🔥

View All

1

3

4

5

6

7

8

9

10

Lifestyle

Sports

View AllAugust 5, 2024

The Future of Sports: Anticipating Trends, Embracing Innovation, Shaping a New Era

Read MoreAugust 4, 2024

The Importance of Mental Training and Psychological Strategies in Helping Athletes Reach Their Peak Performance on the Field

Read MoreTechnology

View All

August 5, 2024

How to Choose the Right Cyber Security Solution for Your Business

In today's digital age, businesses face numerous cybersecurity threats and need to protect sensitive data. To choose the right cybersecurity solution, businesses should understand their specific needs, assess potential threats, evaluate different solutions, consider ease of use and integration, evaluate the provider's reputation and support, conduct a cost-benefit analysis, and implement and monitor the solution effectively.

August 4, 2024

The Role of 5G Technology in Revolutionizing Communication

The introduction of 5G technology is set to revolutionize communication by offering faster speeds, lower latency, and increased capacity for connecting devices. This technology will impact various sectors such as healthcare, transportation, and entertainment. 5G enhances communication through faster speeds, lower latency, and increased capacity, enabling applications like remote surgery, autonomous vehicles, and high-quality streaming.

August 5, 2024

Benefits of Using Cloud Computing for Your Business

Cloud computing has revolutionized business operations by offering cost savings, scalability, improved collaboration, enhanced security, and robust disaster recovery. It allows businesses to access services over the internet, reducing the need for physical infrastructure and providing flexibility.

August 4, 2024

Get to know Blockchain Technology and its Potential in the Future

Blockchain technology, initially known for its association with Bitcoin, has evolved into a versatile tool with applications beyond cryptocurrency. It is a decentralized digital ledger that ensures secure, transparent, and tamper-resistant transactions. Key features include decentralization, security, transparency, and immutability. Current applications include cryptocurrencies, supply chain management, smart contracts, digital identity verification, healthcare, and voting systems.